Cabinet Decisions Details

Breadcrumb

Asset Publisher

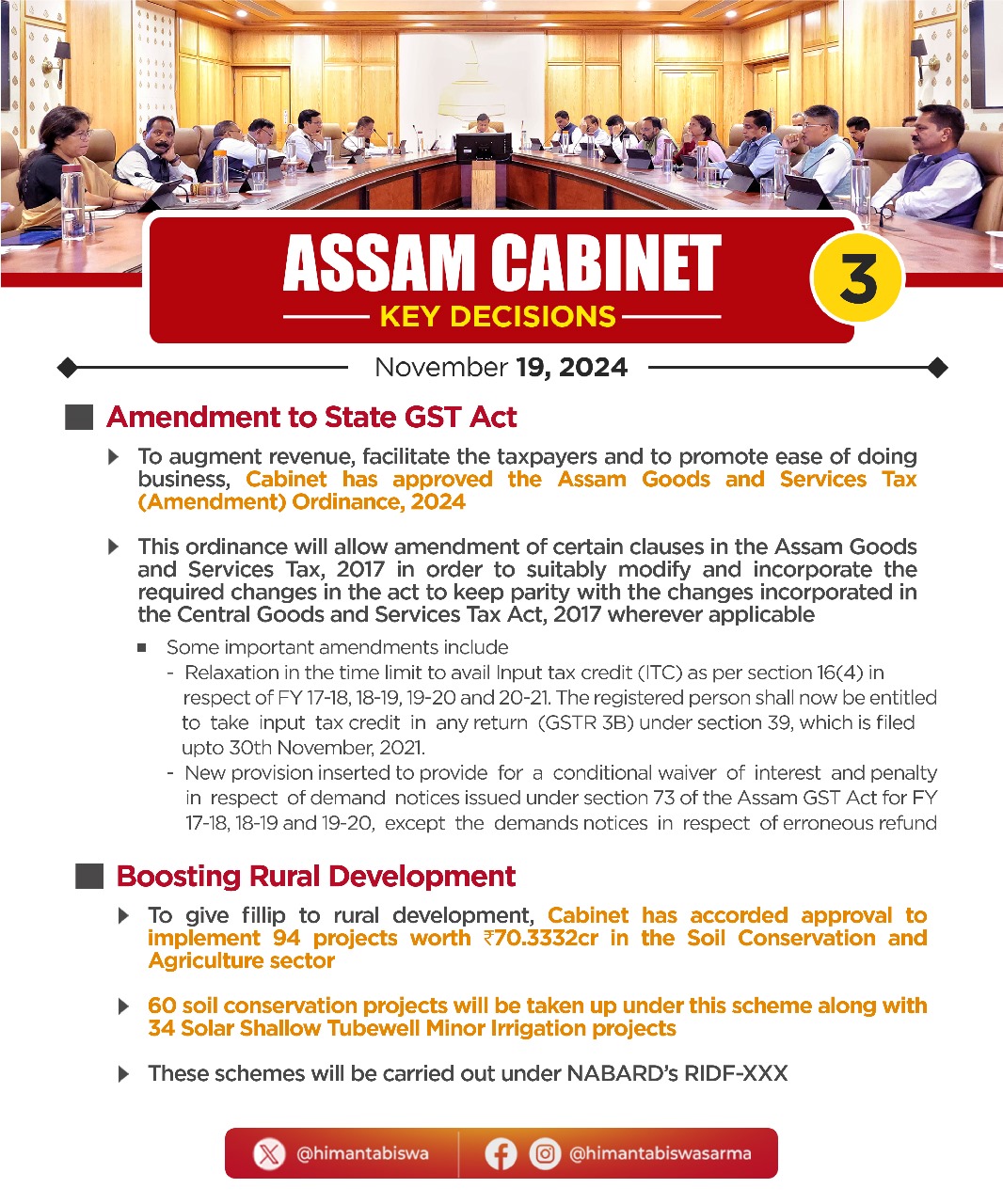

Cabinet Decision on 19 November, 2024 (3)

Cabinet Decision on 19 November, 2024 (3)

■ Amendment to State GST Act

► To augment revenue, facilitate the taxpayers and to promote ease of doing business, Cabinet has approved the Assam Goods and Services Tax (Amendment) Ordinance, 2024

► This ordinance will allow amendment of certain clauses in the Assam Goods and Services Tax, 2017 in order to suitably modify and incorporate the required changes in the act to keep parity with the changes incorporated in the Central Goods and Services Tax Act, 2017 wherever applicable

■Some important amendments include Relaxation in the time limit to avail Input tax credit (ITC) as per section 16(4) in respect of FY 17-18, 18-19, 19-20 and 20-21. The registered person shall now be entitled to take input tax credit in any return (GSTR 3B) under section 39, which is filed upto 30th November, 2021. New provision inserted to provide for a conditional waiver of interest and penalty in respect of demand notices issued under section 73 of the Assam GST Act for FY 17-18, 18-19 and 19-20, except the demands notices in respect of erroneous refund Boosting Rural Development ► To give fillip to rural development, Cabinet has accorded approval to implement 94 projects worth ₹70.3332cr in the Soil Conservation and Agriculture sector ▸ 60 soil conservation projects will be taken up under this scheme along with 34 Solar Shallow Tubewell Minor Irrigation projects ► These schemes will be carried out under NABARD'S RIDF-XXX